Transport industry looking set to bounce back!

Transportation stocks have been closing higher!

A sign of optimism about the economy’s strength that could fuel a broader market rally.

Companies that operate trains, planes, boats and trucks tend to see their prospects brighten when a growing economy boosts demand for goods, materials and travel.

For that reason,

Investors analyze the performance of transportation shares as an indicator that a robust, commercial environment will underpin gains across industries.

The transportation average has advanced 8% in March

The rally is a promising signal for investors worried how the U.S. economy will fare as the Federal Reserve raise interest rates to combat high inflation.

Russia’s invasion of Ukraine spurred the West to impose sanctions and the aviation industry is caught in the crossfire.

As airlines face longer routes to avoid closed airspace and soaring fuel Transportation stocks’ recent leg higher has helped the group recoup its year-to-date losses:

Freight activity has risen lately to reverse some of the decline recorded during the surge of the Omicron variant of C-19. In seasonally adjusted terms

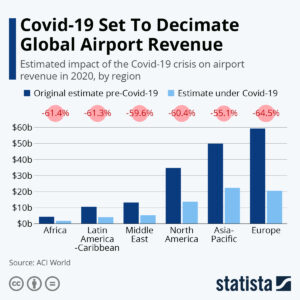

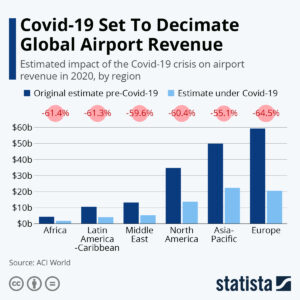

*Statista Chart on Global airport revenues

Airline executives have said demand for travel is bouncing back,

and that they believe customers are willing to pay more to cover higher fuel costs.

Shares of carriers are mixed this year, with Alaska Air Group Inc. ALK -0.44% up 9.8% and American Airlines Group Inc. AAL 1.70% down 3.7%.

“When the airlines reports an increase on demand, that tells you they’re seeing a very strong consumer with disposable dollars for travel,” said Michael Farr, chief analyst “That gives you an indication the consumer is going to be spending in the travel industry.”