Currency Climax, What next for euro and what can we expect from the US dollar?

opinion by arsim@thejournalbiz.com

After the meteoric rise of Bitcoin, which was closely followed by Apple and Tesla shares, now it seems it is the turn of the US dollar to dethrone the euro, and that couldn’t come at a more inconvenient time for the European economy.

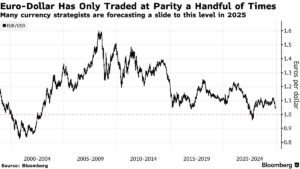

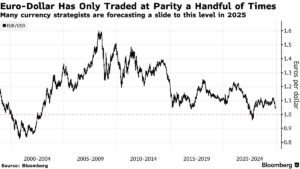

Since the European currency was introduced, some 25 years ago it has only traded at the same value as the US dollar only twice.

The last time when the US dollar reached parity with the euro was the start of the conflict in Ukraine. The conflict quickly turned into a messy war, and that caused an unprecedented energy crisis in Europe. That alone triggered a terrible recession in the whole continent. As a consequence, the European currency trembled and was traded at a 1:1 ratio with the dollar, and that was the second time in the last twenty years.

Bloomberg chart on Euro-Dollar trade parity

Chart Bloomberg

But what is currently happening in the markets, and what are the long-term projections for the currency giants?

If we lean towards the heterodox concepts, then Europe can actually benefit from the strengthening of the US dollar, as this will only increase exports, while imports for US goods shall decrease, as a consequence of higher prices.

The orthodox concept argues the opposite, claiming that if the dollar reaches the nominal value of the euro in the market, then this will inevitably promote inflation and economic stagnation, among other things.

Such claims may well turn out to be true, but the context in which we are is somewhat ‘sui generis’ so nothing is as it seems to be.

It may seem paradoxical, but policymakers often welcome a weaker currency as a means to stimulate economic growth, because the markets love exporting competition.

As I like to mention over and over again, the devil is usually in the details, and here the ‘devil’ is the tariff itself, which Mr. Trump considers as his preferred trademark of exerting diplomatic pressure on the one hand, while he increases the trade balance in his favor on the other.

It is therefore likely that claims of positive impacts could be undermined if the US imposes tariffs on European goods.

A weaker euro also makes it more expensive to import raw materials, and this could reignite the debate over the price pressures that European consumers could face if new tariffs come into force.

As for the speculations that there will be price increases, and renewed inflation in Europe, this may also be a blown out of proportions scenario. One of the reasons why I say this is that, despite the war in Ukraine, Europe remains the safest and most profitable partner for American corporations, and in the event of any trade escalation, both sides will suffer proportionally.

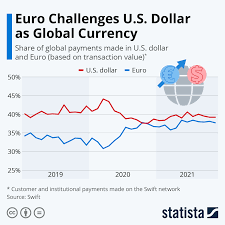

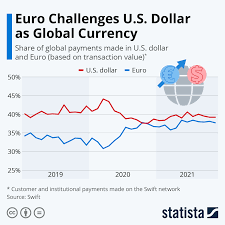

Statista on main currencies used for global trade

Chart:Statista

In fact, the exchange parity at 1:1 is more of a psychological factor than an economic one.

Based on these projections, investors and policymakers alike are prepared for a period of instability for the euro, as conversion options on the market may favor the dollar, and this can create an imbalance that could spur the euro lower than a 1:1 conversion.

- However, the euro despite its stability in the past, is better known for its fragility every time the markets are exposed to global crises.

We can cite two situations in which the European currency trembled from the latter.

The first one, artificial pumping, or increase when it began its circulation in 2000. As we can recall, it managed to dominate the US dollar by a conversion rate of 1 to 1.6, while the second, was its drastic decline on the first serious challenge which was the energy crisis triggered by war in Ukraine.

To refresh our memory, the euro suffered a drastic decline, 72 hours only after Russia attacked Ukraine, and immediately after was traded 0.97 to 1 in favor of the dollar. Yet again, this may serve as another proof that the euro is more like a ‘dog that only barks’ rather than a serious project that unites and represents the union of values, as the European continent claims to be.

The other risk remains the political factor, and this could encourage populist politicians who oppose the common currency, such is the conservative right party in Germany (AfD), which is already planning an election campaign advocating the country’s exit from the EU and immediately after leaving the euro currency project.

Last but not least, are the European consumer.

Consumers can gain in the long term as their local tourism will soar as they turn to buying locally manufactured goods. That may lead to increased production, and competitive prices in the market, and the markets will favor goods ‘made in Europe’

Meanwhile, the decline of the euro can boost sales of products that have recorded huge losses recently, and here I specifically mean the German auto industry, which is slowly but surely heading toward total collapse.

Ironically, with currency parity sales can return, along with the interest of global consumers in European brands.

In this way, just as Einstein claimed that ‘in the midst of crisis, there’s an opportunity’ Europeans too can seize this unique opportunity, while their currency continues to shrink against the US dollar.