EU’s tariff hikes on China’s EV will penalize the German auto-industry the most

Opinion by arsim@thejournalbiz.com

Just recently, Bloomberg reported on the European Commission’s decision to raise tariffs on all Chinese electric vehicle manufacturers, without exception.

The move that will further deteriorate the intercontinental Eu-China trade and is likely to cause what is known as ‘the last nail in the coffin ‘ for the German auto manufacturers, the ones that still consider the Chinese market as essential for their profits, as well as brand expansion while safeguarding their market share remains a priority.

Electric vehicles or EVs as widely known, like any other commercial product aim the mass consumers for sale to maximize profits, and that sale recently has been quite a challenge to keep up with, as local competition has proliferated in China.

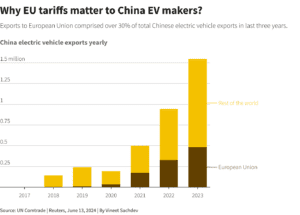

Chart on China’s EV export rise in Europe, 2023

Chart: Reuters

The recent tariff hikes from Europeans are the very same protectionist measures that they disputed in the past when former president Trump went into a ‘tit for tat’ tariff war with China.

However, the tables have turned recently, and as things stand the ones who will be affected the most will be the European consumers. And to make everything worse than it already is, domestic production within the EU will be severely affected too. In other words, the German auto industry will face a modern ‘trojan horse’ scenario with recent inflation and energy prices skyrocketing, the tariff burden will likely to cause more harm than will do any good, in particular to the auto industry itself.

Chart on Mercedes yearly sales and China’s market share

The industry unfortunately is in decline, as the trade deficit with China keeps rising.

Last year, Germany set a new low with China, recording over 90 billion dollars in trade deficit. The rising energy bills, on top of rising production costs and inflation, kept the production migration flowing toward China, as a more preferable low-cost destination for major brands.

However, the latest EU proposal on tariffs will prove to be a double-edged sword for German industry itself, as both Germany and Europe are facing one of the biggest crises in forty years, and a tariff war with a country where European manufacturers already have their businesses will only worsen the situation overall.

Germany’s trade deficit with China. 2023 YoY

Source: Destatis

But what could one expect from the EU Commission, when the latter for decades failed to convince countries like Kosovo and Serbia to reach a basic agreement?

The European Union, despite having its largest Rule of Law mission in Kosovo, failed to achieve any result whatsoever in the dialogue that is not only sponsored, but financially supported with billions of euros by its taxpayers.

There’s a consensus that the dialogue between Kosovo and Serbia is arguably less complicated to deal with than the tariff issue with China, and if the EU fails to resolve the issues between Kosovo and Serbia, then how exactly they are planning to deal with China?

China’s market remains very appealing for Western brands, especially German ones, and here are some key facts on why :

- Last year, the Chinese market accounted for circa 42% of global sales of BMW and Mercedes vehicles.

- Along with Mercedes and BMW, China is the largest market for the Volkswagen brand too, accounting for about a third of yearly sales.

- Tesla has one of its largest manufacturing plants in Shanghai, where it produces about 3 million vehicles per year.

In short, China is the largest destination for German vehicles according to the German Automobile Association.

So, if the tariff increase on Chinese imports comes into force and excise duties begin in July, then as a consequence the EU should prepare for the aftermath of what happens after China retaliates with tariffs for the EU brands, and make no mistake they will.

What’s more, many investors have already invested in European stock markets, and decisions like these harm their portfolios, because all German brands registered a 20% drop since the news on tariffs hit the market.

In conclusion, the Chinese market remains lucrative for foreign manufacturers, especially the German ones, and the tariff hikes by EU will undoubtedly affect the EU’s top brands and consumers.

As far as European trade goes, the prospect of ‘Murphy’s law’ is very much applicable here, and after the energy crisis and the never-ending war in Ukraine, the tariff issue can be considered not only a setback to the green transition but a real blow to the German economy too. And without the German economy thriving, we can hardly imagine a Europe that will be able to compete in a very challenging fast-growing global market, and if you don’t compete then you better be prepared to lose further grounds on the consumer front.