Global trade crisis, what can we expect from the latest U.S. ‘tit for tat’ tariff war

opinion by arsim@thejournalbiz

From the very beginning of his second term, or Trump 2.0 as some prefer to call it, the new U.S. administration started with unexpected dynamics in bilateral relations with almost the rest of the world, while the main attention remains the conflict in Ukraine. However, one thing that we can still encounter that started during his first term is tariff retaliation. We can argue that the topics of free trade and tariffs became his traits, that will never change and his tendency for reciprocity or using the tariffs as a levy, are his favorite political tools.

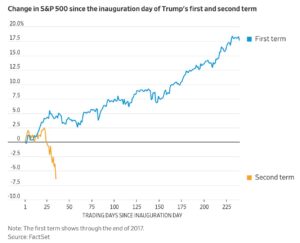

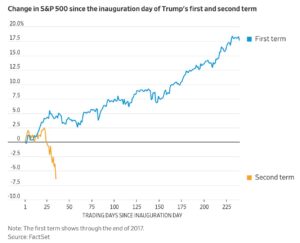

In short, for the Trump administration almost always the end justifies the means. Not coincidentally, Mr. Trump’s main indicator of foreign policy is trade reciprocity, but sometimes the stock markets react negatively to the tariff uncertainty.

Factset chart on stock market reaction on Trump’s first term and the second one

Source: Factset

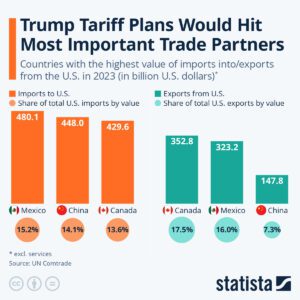

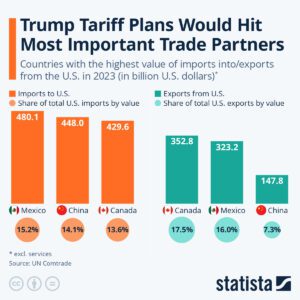

Randomly and whenever the topic on trade reciprocity is on the agenda we simply have to rely on fundamentals, and by fundamentals, I mean statistics or the percentage of tariffs on goods and services. That is, whether they are favorable or unfavorable for American products, taking into account the cost of production, transportation, additional taxes, and so on.

If we encounter numerical discrepancies here, or if we have a trade imbalance ‘vis a vis’, then that triggers Mr. Trump’s response on demanding the implementation of tariffs against the relevant countries to achieve, as he himself likes to say, trade reciprocity. This constitutes his MAGA plan, in order to ‘Make America Great Again’ according to the famous pre-election campaign.

- But what specifically lies behind the tariffs that are expected to come into force on April 2nd, and how will that all look, from the macroeconomic perspective?

Increasing tariffs as a political tool to negotiate with neighboring countries, or with those countries that are characterized as ‘complicated countries’ is not unknown in economic or diplomatic circles. Tariffs on goods, which are essentially additional taxes on producers and consumers, remain the opposite of what we know as the ‘free market’ for which the founder of liberal economics, Adam Smith courageously stood for.

Statista on Trump Tariff Plans Projections

Source Statista

It is worth noting that it is not Mr. Trump who invented the tariffs method, which is being perceived as a retaliatory measure.

In fact, it was President Reagan who started with tariff measures to protect the steel industry in the US. While President Trump did the same in his first term, something I wrote extensively about at the time of implementation.

However, this time we have a more expansionist approach than the last time from the new U.S. administration where almost every commercial product is included in additional tariffs. From the automotive industry to advanced technology products, including agricultural products, no sector has been left behind because the new administration demands one thing persistently, and that is trade reciprocity.

What seems unusual this time is that Mr. Trump is not only choosing certain countries to protect specific U.S. industries, as the aluminum and steel industries are considered, but he is blocking imports across the entire trade spectrum, and he is doing so with almost all countries without exception.

Even more unusual is his attempt to link the issue of the illegal drug ‘fentanyl’ with the tariffing of several countries where it is allegedly produced.

In modern history and as far as I am aware, we did not have a single case where a President has tried to link an illegal drug crisis to a trade policy, as Mr. Trump is doing with fentanyl today.

But we must keep in mind one thing, whenever we discuss Trump’s next move, the saying ‘expect the unexpected’ applies, and therefore the markets, along with Bitcoin, have suffered a drastic decline all due to fear and uncertainty in the market.

On the other hand, the tariff measures are realizing their first successes for the American industry.

Within a very short period of time, Mr. Trump has managed to bring back to the American market the giants of innovative technology such as ‘Apple’ and ‘TMSC’. While many other renowned companies, including Honda and Samsung, have already begun plans to relocate their production units to American soil.

As for the European Union is concerned, they will also face an additional tariff of +25% from the 2nd of April, but until then we will wait and analyze all the reactions that are usually repetitive and very predictable from the European Commission. Until then, only one thing remains certain, and that is that we will have rising inflation this year and consumers worldwide continue to pay the toll of irresponsible elected officials.

@thejournalbiz.com

written and researched by arsim@thejournalbiz.com