Goldman Remains Bullish on ‘Gold’ as Central Banks Buy, Fed Cuts

Bank reiterates forecast for the jump to $3,000 an ounce next year.

Trump’s policies may augment metal’s bull case, Goldman says.

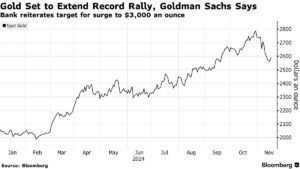

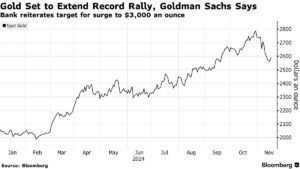

Bloomberg chart on Gold projection by Goldman Sachs

Gold will rally to a record next year on central-bank buying and US interest rate cuts, according to Goldman Sachs Group Inc., which listed the metal among top commodity trades for 2025 and said prices could extend gains during Donald Trump’s presidency.

“Go for gold,” analysts including Daan Struyven said in a note, reiterating a target of $3,000 an ounce by December 2025. The structural driver of the forecast is higher demand from central banks, while a cyclical lift would come from flows to exchange-traded funds as the Federal Reserve cuts, they said.

Gold has staged a powerful rally this year — hitting successive records — before pulling back in the immediate aftermath of Trump’s White House win, which boosted the dollar. The commodity’s advance has been underpinned by increased official-sector buying, and the Fed’s pivot to easier policy. Goldman said a Trump administration may also aid bullion.