How the ‘Trump Trade’ is Making the Bitcoin Great Again!

opinion by arsim@thejournalbiz.com

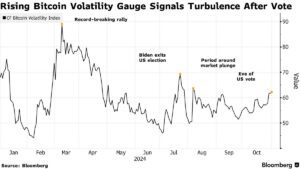

Since the start of the pre-election campaign in America, bitcoin has experienced unforeseen volatility, and that’s because it suddenly became part of the election campaign. Ever since Trump’s endorsement, everybody has been talking about Bitcoin, which proved decisive for the mainstream media to put the digital coin into the global spotlight.

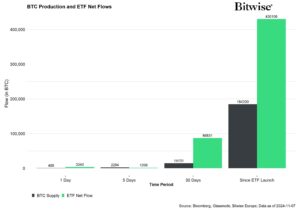

This year, and especially since the US Securities and Exchange Commission (SEC) approved ETFs, bitcoin has experienced tremendous growth. This is not only because of the political support it received from the newly elected President of the U.S.A. but also because of the massive inflow of investors’ dollars into ETFs.

Bitwise chart of ETFs

While media coverage is considered to be a blessing in disguise, as media giants, the likes of Bloomberg, Wall Street Journal, and Financial Times, covered the bitcoin theme 24/7 and that was considered a free advertisement for every investor around the globe to engage more on the current market buzz, until the bitcoin entered the sphere of interests of the so-called ‘ whales’ or financial moguls, as Trump made crypto world part of his political agenda.

We may recall the event that is considered a bitcoin endorsement when Trump described Bitcoin as an asset class with a real market value, worthy of being classified as a federal reserve.

Consequently, the turning point is that particular speech made at the international conference dedicated to Bitcoin that was held in Nashville, Tennessee in July, where Mr. Trump, among other things, declared that ” we will make America the capital of Bitcoin” and this was the beginning of a new era for the bitcoin, and as we speak bitcoin is marking new records and currently is being traded at 88 thousand dollars per unit.

Bloomberg Chart on Bitcoin Election Effect

For years, bitcoin has been characterized more as a parody than an asset class, while speculation grew as institutional investors couldn’t grasp what Bitcoin actually is.

The whole skepticism, to a degree, could be justified because we have over four thousand other crypto coins, which truth be told, I find it impossible to identify any value whatsoever in the market.

Not only do they have nothing in common with bitcoin, but quite on the contrary, bitcoin is a limited supply asset, backed by computer miners, and relies entirely on cryptography and blockchain technology.

In fact, the only thing the other crypto coins may have in common with Bitcoin is the digital platform they coexist on.

But what exactly is Bitcoin?

Unlike traditional currencies, shares of public companies, or real estate, bitcoin is a fully decentralized asset backed by computer cryptography that operates independently on a digital database known as blockchain.

Although there is no value guaranteed by any central institution, (as Central Bank is) based on monetary reserves or physical properties.

However, the real value of Bitcoin is determined by three critical factors;

- Limited supply and growing demand

- Security and scalability

- Private and decentralized

Not coincidentally, the victory of Mr. Trump is also being considered a victory for Bitcoin due to the positive sentiment and the global hype that this news has evoked, being considered a valuable asset or a national reserve, similar to gold and oil.

In sum, global crises and rising inflation helped Bitcoin reach new records, now registering a 23% rise within 14 days.

Economist chart on El Salvador turning towards Bitcoin

But how can underdeveloped countries endorse the bitcoin, as El Salvador for example benefited from bitcoin endorsement three years ago?

Specifically, what can Western Balkans do more to fight endemic corruption? and,

How can Kosovo turn into a crypto-friendly place, instead of remaining a ‘place to avoid’ by institutional investors ?… a topic to discuss in days to come.