Investing: bonds or stocks?

Opinion by Arben Selimi

(*special thanks to Arsim. Ajeti for contribution)

Many individuals and companies have surplus money sitting idle. They don’t use it for consumption nor they invest it to earn them some profit or interest. The least they can do is to deposit this surplus money in a local bank who in return will pay them interest, usually 1% to 2% yearly. Or, better yet, they can invest that money into the stock market, to hundreds of companies looking to expand their business. When they do that, giving away money in exchange for a future profit, they become investors.

You as a potential investor, before you invest your money, need to obtain information about the company whose stock you are about to buy. Your find this information in company’s annual reports which are published usually in the beginning of each year. These reports include, a narrative about the company’s business and its financial statements that show the revenues it generated and expenses it incurred and its earnings during one year. Obtaining these, and other information about the company, is of major importance not only to the potential investors, but to the current ones as well.

To be able read and understand these reports, one must have at least basic knowledge about accounting. Various items from the financial statements are used to calculate a number of indicators, of which, investors are most interested in the profitability index of the company.

Financial analysts derive profitability index from the income statement and from the statement of financial position also known as the balance sheet.

There are several indexes that measure company’s profitability, but before we go to the indicators, we need to understand the difference between sales revenue and profit.

Sales Revenue is all the money that the company has collected from the sales of its products.

Selling products causes some costs to the company.

Gross profit is what remains of revenue after deducting these costs.

Net profit is what remains of revenue after deducting other expenses such as administrative expenses, rent, tax, etc. This profit can be distributed to the owners i.e. the investors.

To illustrate we will give an example:

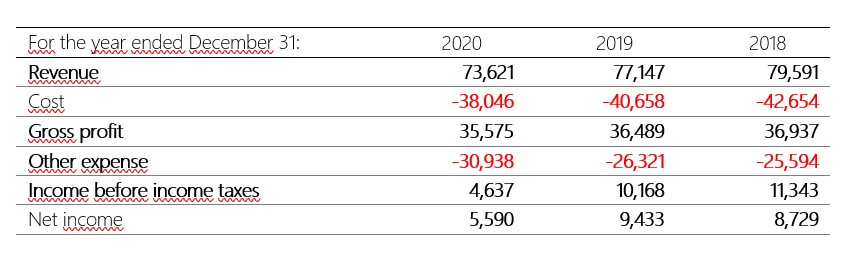

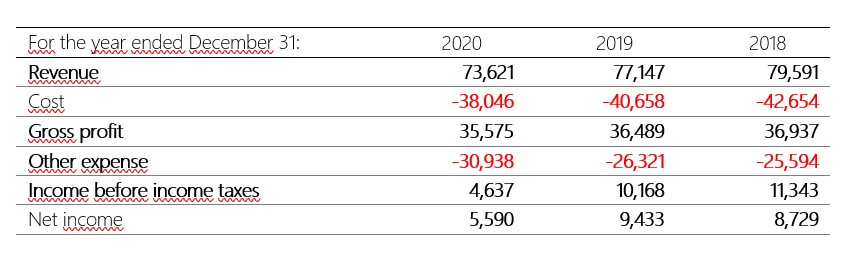

Company IBM during 2020 generated revenue of $ 73,321 million from sales, services and financing operations. The cost of these was $ 38,046 million. Additionally, it had sales, administrative and other expenses amounting to $ 30,938 million. That left them with a total of $4,637 million income before taxes.

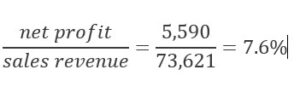

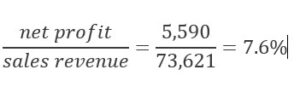

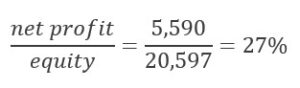

This is the statement of income and expenses. IBM has earned a net income of $ 5,559 million from a sales revenue $ 73,621 million. Gross profit margin is 48% and the net profit margin is less than 8% of the sales. This is also called the return on sales, calculated by dividing:

This means that our company earns approximately 8 cents for every dollar made in sales.

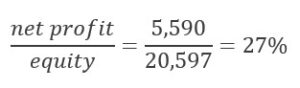

Investors want to know how much they earn from their investment. We can use the net profit again to determine the ratio called the return on equity. From IBM’s balance sheet we find that the value of the equity totals $ 20,597 million then we calculate the return on equity as follows:

Return on equity for IBM shareholders for year ended 31 December 2020 is 27% which can be interpreted like this: shareholders have earned 27 cents for each dollar that they have invested in IBM during 2020. This is a relatively high profit as successful companies usually have a rate of return on invested capital (equity) from 15% to 25%.

So, when faced with the dilemma to deposit money in a bank or to invest in stock market, it is obvious that the interest rate of 2% offered by the bank is significantly lower than the return on investment that the publicly traded companies can potentially realize and distribute.