Stocks Show Signs of ‘Getting Tired’ After Rally

Stocks lost steam following a furious post-election rally that spurred calls for a halt amid signs of buyer fatigue.

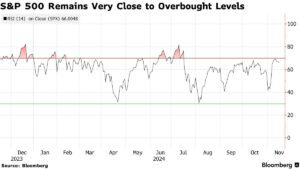

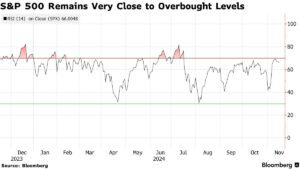

Equities fell from near all-time highs, with the S&P 500 remaining close to technically overbought levels. That’s after a surge that drove the benchmark gauge up 25% this year.

Bloomberg chart on S&P 500

Several measures highlight stretched trader optimism, including the latest figures from the American Association of Individual Investors, which showed a spike in bullish sentiment.

“The stock market is showing signs that it’s getting ‘tired’,” said Matt Maley at Miller Tabak + Co. “It could be due for a bit of a pullback soon — which would be normal and healthy.”

Morgan Stanley’s Wilson sees near-term S&P ceiling at 6,100

UBS strategists says US equities grinding higher into year-end

In the run-up to Jerome Powell’s speech on Thursday, traders waded through economic data. US producer prices picked up in October, fueled in part by gains in portfolio management and other categories that feed into the Federal Reserve’s preferred inflation gauge. Applications for unemployment benefits fell to the lowest level since May.

“The question we have is whether Powell’s dovishness will reset the tone for higher long rates. On that question alone, we say ‘no for now’,” noted Andrew Brenner at NatAlliance Securities. “But he will continue to support Fed easing in the near term, and even that will have a limited effect.”

The S&P 500 dropped 0.2% to around 5,970. The Nasdaq 100 slipped 0.1%. The Dow Jones Industrial Average lost 0.3%. Automakers like Tesla Inc. and Rivian Automotive Inc. slumped as Reuters reported President-elect Donald Trump plans to eliminate the $7,500 consumer tax credit for electric-vehicle purchases. Walt Disney Co. jumped on a profit beat.

*Treasury 10-year yields slid five basis points to 4.41%. The Bloomberg Dollar Spot Index wavered.