Twitter trilogy; ‘Bots’, shareholders, and Elon Musk!

Op/ed by the editor: Arsim.Ajeti

arsim@thejournalbiz.com

*special contributor Tracy

One of the most attractive sectors for the retail and institutional investors undoubtedly remains Technology, (tech) and where social media stocks are considered a valuable asset for investment, long and short term wise!

However, today the projections are very volatile and dim to say the least, inflation is soaring,while the Twitter deal collapsed, and the whole deal will undoubtedly, one day be considered one of the most (if not the most) controversial acquisitions ever in the social media world

Tweet on Elon’s no deal w/Twitter

Elon ends his $44 billion deal to buy Twitter@Twitter shares fell 6% in after-hours trading, immediately following the news, after ending the day down 5%. @Tesla stock gained more than 1% in after-hours trading

Saga likely to continue in Court!#ElonMuskhttps://t.co/SyTuT3XFtM— The_Journalbiz (@the_journalbiz) July 12, 2022

But let’s start from where it all began,

and that is when Twitter presented data that did not match reality, or so it seems, according to Musk, when he simply refused to believe to what Twitter was claiming, that there are less, or in a region of 5% of its total accounts may be considered ‘bots’ or fake

Several reports argued otherwise,

Research consultancy ‘Cyara’ came up with a detailed research report with up to date data and statistics, where it gave us a completely different picture, showing that circa 14% of all accounts are believed to be ‘bots’ or fake accounts and that’s where it all started the trilogy between Elon and Twitter.

As a consequence, Twitter shares fell by roughly 7% ($34.30) so did the other shares (where Elon is the founder & CEO of, Tesla) as a reaction to the deal as, Elon would have to sell a chunk of Tesla shares, in order to finance the acquisition of Twitter, the deal that was considered overvalued by many market experts and analysts, due to the final price, that of $44 billion or ($54.20 per share of Twitter)

*Investing tweet on US Stocks and inflation

*U.S. STOCK FUTURES POINT TO LOWER OPEN AHEAD OF EARNINGS, INFLATION REPORTS

🇺🇸 🇺🇸 pic.twitter.com/DhUysbIX5O

— Investing.com (@Investingcom) July 12, 2022

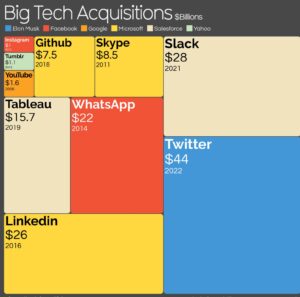

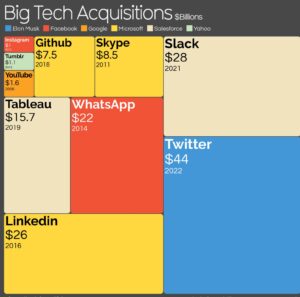

But let’s go back to the history and stats, so that we can briefly review how the other acquisitions look like:

2006; Google finalized a deal with YouTube, and the final price was, believe it or not, just $1.6 billion

2012: Facebook finalized agreement with Instagram, for a price of only 1 billion dollars (and just where would Facebook be today without Instagram?)

2016; Microsoft finalized an agreement with LinkedIn for 26 billion dollars and recently added the electronic games giant ” Activision” helping Microsoft slowly transform from a giant of software company, into a real technological conglomerate

While Elon’s attempt acquiring Twitter for 44 billion$, how do we rank this, and how the market reacted?

Chart projection on biggest Tech Acquisition

Based on what other tech giants paid for their acquisitions, we can safely highlight the discrepancy of the twitter’s price and Elon’s offer, did he really acted based on a well-studied business projection and calculated the real market value of the Twitter, or he went based on a ‘hunch’

Last but not least,

The Twitter board, went against upon hearing the news that Mr. Musk is planning to buy Twitter, even claiming that they would implement the so-called “poison pill” (to protect by all means, the purchase by Musk), while today they claim the opposite, and are willing to sue Mr. Musk if he doesn’t go ahead with the deal!?

*Bloomberg tweet on Musk v Twitter board

JUST IN: Elon Musk has decided not to join Twitter’s board, CEO Parag Agrawal says in a tweet https://t.co/2CTEBx6RoS

— Bloomberg (@business) April 11, 2022

Nevertheless, there is little to no room, to argue as we have no sufficient data on why exactly the Board went against in the first place, and secondarily by what standards, did the Board act ? the sudden shift and the whole overreaction by the Twitter board, leaves room for speculations.

If that wasn’t enough, then here’s the latest,

Musk, just a few hours ago through his tweets, claims to be eager to expose the “Bots” through the legal proceeding, ( as Twitter is claiming to initiate), on the basis that Mr. Musk is walking away from the deal, (the one that the same Twitter board fought so hard against months ago!

Elon’s tweet on latest twitter saga

— Elon Musk (@elonmusk) July 11, 2022

This sums to one of the strangest events in today’s business and international market, all this happening in midst of the global crisis, inflation and the never-ending war in Ukraine!

As a conclusion,

the world which we all knew once has changes significantly, since the pandemics nothing is the same, the crypto boom and bust cycle, the high and lows on stocks and inflation, the Elon’s deal/no deal and the role of his tweets on the market price swings, it leaves us with more question than answers, as this saga is far from over, it just started as Trump called Musk ‘b***t entrepreneur”, it is a never ending story and it all starts with one of the most innovative individual on earth today, the Elon Musk factor.

@thejournalbiz

Opinion by arsim@thejournalbiz.com

contributors: tracy@thejournalbiz.com arben@thejournalbiz.com