Drone market research trends and future projections

Opinion by; arsim@thejournalbiz.com

The proliferation of the drone industry is driving manufacturers toward a competitive and dynamic global market for local manufacturing of military drones

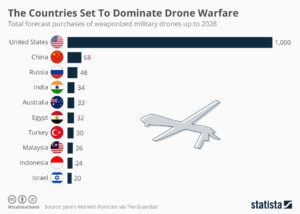

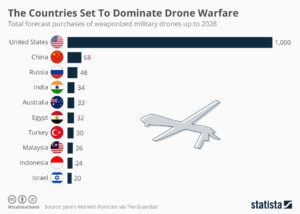

Data shows that the market value is expected to reach $28.8 billion by 2025, out of $12.6 billion estimated currently by Statista.

Tweet on Drone market projections

Drone market value will grow at a CAGR (Compound Annual Growth Rate) of 13.8% to almost double that in 2025, according to @Statista#drones #military pic.twitter.com/ZN9SpaHJ8w

— The_Journalbiz (@the_journalbiz) August 18, 2023

Statista Chart

Undoubtedly, successive global crises, such as the war between Azerbaijan and Armenia, also known as the ‘Nagorno-Karabakh’ conflict, and the current conflict between Russia v Ukraine accelerated the demand for a fundamental change in the drone industry.

- The demand for armed drones is rising steadily.

Just recently the Balkan states joined the race of having a drone or two within their military stock. When we talk about drones in general, we shouldn’t focus primarily on military ones.

In fact, the market considers this product as the future of prime deliveries as is the case with the largest online retailer in the U.S, the Amazon

However, consecutive crises modified the demand for specific drones.

Today drones are considered easily maneuverable devices that cost cheaper than other ‘alternatives’ such are: helicopters, or fighter jets for instance.

Despite the fact that it lacks clear regulation, drones represent a ‘golden’ opportunity for innovation for emerging markets, such are the countries of the Western Balkans.

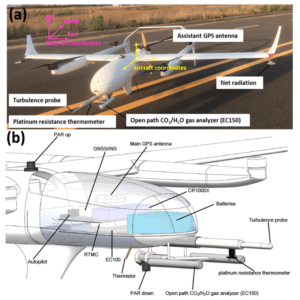

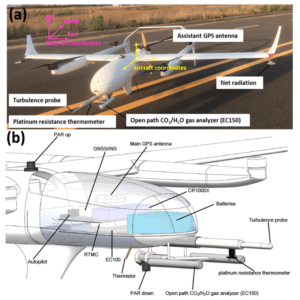

Blueprint of Delivery Drone

Droneworld chart

In fact, the current trend should be considered an opportunity for Western Balkans.

Just like Turkey, which started small, the region might aim for the production of spare parts for the rising industry ( if not the product itself)

A case study reference to the latter is in fact the story of the success of the Turkish startup Bayraktar.

It is worth noting that drones have mainly been used for commercial purposes, surveillance as well as search and rescue missions in natural crisis emergency situations.

Since the pandemic, drones have been redesigned and proven to be reliable means of transportation, especially in isolated African countries, as is the case with the startup Zipline and its mission in Africa.

In order to grasp the drone prospect and the commercial potential more clearly, we have to go back a few years and analyze the Turkish startup Bayraktar, which has already made a name for itself and today is considered a reliable brand in the military drone market.

- Years ago, Bayraktar started the production of drones known as TB2.

In co-financing with the Turkish state and through diplomatic channels, Bayraktar targeted the ‘crisis regions’ as their potential market.

In this way, countries out of necessity didn’t hesitate to equip themselves with TB2 drones, due to low cost and high efficacy that the drones provided, otherwise in economic terms known as ‘supply & demand’

The first customers for Byraktar drones were Syria and Libya. Soon after Bayraktar drone appeared in the Nagorno-Karabakh conflict, in which Turkey clearly positioned itself on the side of Azerbaijan and massively supplied it with TB12 drones, that by default led to Azerbaijan’s successes on the ground.

Consequently, the value of Turkish startup Bayraktar skyrocketed in the market. Russia’s invasion of Ukraine was another ‘blessing in disguise’ for Bayraktar drones.

Today, Bayraktar supplies 12 countries and is estimated to be worth about 4 billion dollars in the market.

Statista on Military drone market domination

Statista Chart

Recently, amid local tension between Kosovo and Serbia both countries acquired defense drones, which means that in case of tensions, drones can also be used for military maneuvers.

How well-equipped are the Balkan states?

Years ago, Serbia received 6 surveillance drones and 10 combat drones from China, specifically the CHU-92 A model.

In addition, through a memorandum of cooperation, Serbia has also sent a team of experts to China to exchange experiences and learn the secrets of building combat drones.

As a consequence, Serbia is expected to produce domestic drones for the international market, and this, from a business point of view, is considered very profitable.

- The Balkan countries generally cannot claim any distinctive brand production, much less in the defense industry.

But where does Kosovo stand in the drone industry?

Recently as Reuters reported, Kosovo managed to acquire Byraktar drones. The Prime Minister himself publicly displayed the event

But will the latest acquisition make any difference in the long run?

Apparently not, as Kosovo is lacking in innovation as well as production in the tech sector.

According to the Riinvest Institute, Kosovo ranks 140th out of 154 countries in the world in terms of innovation, while unemployment and migration remain at extremely high levels.

For Kosovo, perhaps the time has come to consider innovation as a way out of the crisis and migration that has gripped the country for decades. Leaving aside populism and the empty political rhetoric, Kosovo is about to face a Shakespearean dilemma, ‘To be, or not to be’.

In a world where innovation marks significant growth, Kosovo is grappling with migration,

At a time when startups are increasing in number worldwide, corruptive affairs are the only buzz in the mainstream media.

Thus, a radical approach and reflection by Kosovo’s society is a must, rather than a choice. Otherwise, the crises and economic stagnation will be part of Kosovo’s society for the unforeseeable future.

@thejournalbiz

Drone market research trends and future projections

arsim@thejournalbiz.com