Fed’s Digital Dollar Handles 1.7 Million Transactions Per Second!

As the race against China’s development of its central bank digital currency (CBDC) known as the digital yuan continues, the U.S. Federal Reserve accomplished a feat in testing a design for a U.S. digital dollar that managed to handle 1.7 million transactions per second.

A report released provided the initial findings of research conducted as a collaboration between the Boston Fed and Massachusetts Institute of Technology (MIT).

Dubbed ‘Project Hamilton’, the report describes a theoretical high-performance and resilient transaction processor for a ‘CBDC ‘that was developed using open-source software called ‘Open CBDC’.

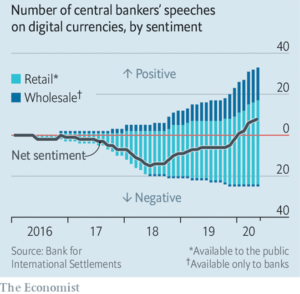

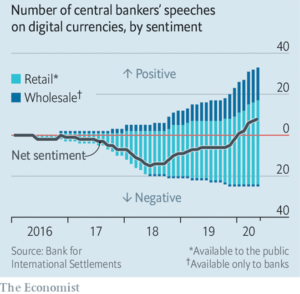

*Chart by:The Economist

According to the Fed’s Report, a core processing engine for a ‘hypothetical general purpose’ CBDC was created that produced one code base capable of handling 1.7 million transactions per second.

- According to the Fed, the vast majority of transactions reached settlement finality in under two seconds.

“It is critical to understand how emerging technologies could support a CBDC and what challenges remain” said Boston Fed Executive Vice President and Interim CEO Jim Cunha.

“This collaboration between MIT and our technologists has created a scalable CBDC model that allows us to learn more about these technologies and the choices that should be considered when designing a CBDC.”

But speed and tech aren’t the only issues.

The debate over the creation of a digital dollar will likely focus on many other issues, including “whether or how to adopt a central bank payment system for the United States,”

Neha Narula, director of MIT’s Digital Currency Initiative said.