Inflation effect: is it worse on stocks or gold?

Opinion by Arben Selimi

*special contribution by Arsim.Ajeti

Most stocks are down this year, mainly due to the high inflation and the measures that the FED and ECB have taken in an effort to fight it since the beginning of the year, by raising interest rates.

They are now trying to “fight” inflation, which they themselves caused during the pandemic, by printing enormous amounts of money. Unprecedented!

Few companies have remained unaffected by the “bear market”. Meta platforms (formerly Facebook) stock for instance has plummeted by 63.5% compared to a year ago. Bitcoin and all cryptocurrencies have suffered drastic declines. But the worst is that companies like Nike have also suffered a decline. Nike’s share price has plummeted by 53% (from $177.51 to $83.12).

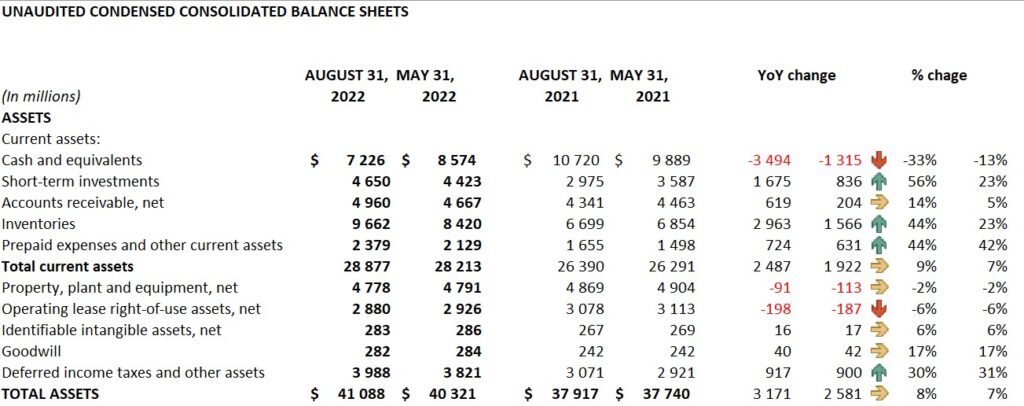

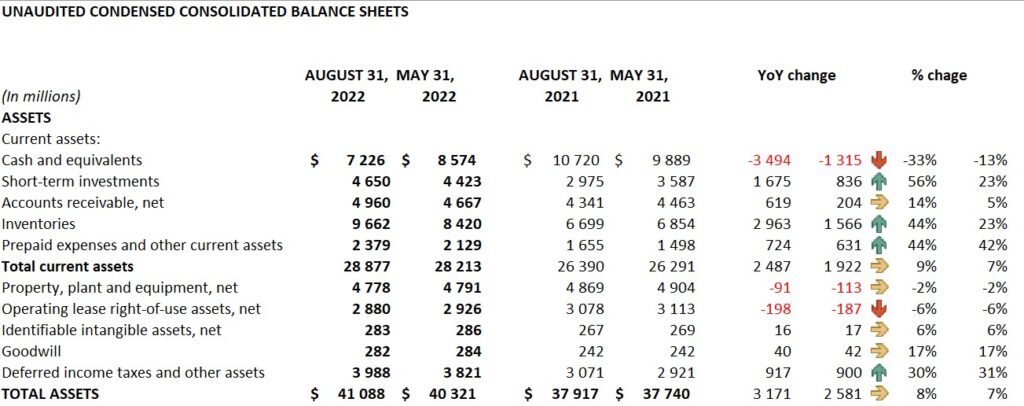

According to the 10-Q report covering period ended August 31, 2022, the company reported that there was an increase in inventory by 44% year on year. This means that Nike has achieved its production plan but not the sales plan too.

This is a sign that inflation has already begun to show its effects on consumption. People have the same amount of money as they did a year ago, but they don’t have the same purchasing power. They spend most of their income on basic items, so they don’t have much money and don’t have the luxury to buy unnecessary things, even something like sneakers.

Chart 1: META vs NIKE stock price October 2021-October 2022.

However, tangible assets, like real estate and commodities, have historically been seen as inflation hedges, proven in the past scenario to be a stable investment during inflation.

Whether it’s a studio apartment, multifamily or even commercial real estate, many investors are paying more attention to the asset class for its stability and tax benefits while stock markets look murky during the inflation

While the key points measuring inflation remains the Consumer Price Index (CPI), measures the weighted average consumers pay for a standardized market basket of goods and services, and the Producer Price Index (PPI) is a weighted average of prices realized by domestic producers.

Tweet on Consumer expectation by FED’S

A survey of consumer expectations released Tuesday by the Federal Reserve Bank of New York presented a mixed bag for policymakers.

Americans' median inflation expectations over the next year continued to fall to 5.44% in September from 5.75% a month earlier. pic.twitter.com/dDI23vThLm

— The_Journalbiz (@the_journalbiz) October 12, 2022

Meanwhile, the price of gold has been relatively stable, down 8.33% compared to a year ago, to $1,656.30 from $1,806.80

Chart 2: Gold price October 2021-October 2022.

Gold has always been a store of value and is proving to be so even now, compared to other types of investments.