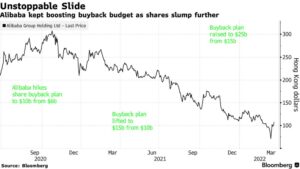

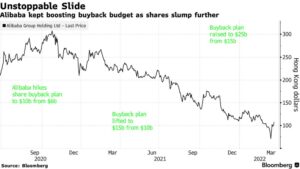

Alibaba, buybacks $25 Billion of its stocks!

Alibaba inc. boosted its share buyback program to $25 billion from $15 billion,

in a bid to reassure investors about the company’s prospects after a year in which its stock has fallen by more than half.

According to FactSet, a market capitalization of circa $270 billion, as buybacks are substantial, compared with the Chinese e-commerce giant’s market value

- The modified repurchase program will be effective for two years through March 2024, Alibaba said today.

The staggering 67% increase directly allocated for buybacks was “a sign of confidence about the company’s continued growth in the future.”

- Chinese tech stocks in Hong Kong, China and in the U.S., have been highly volatile recently

amid worries that U.S. regulators may move to delist Chinese companies and signs that Beijing’s long-running regulatory crackdown will continue.

Factset finds that Alibaba’s New York Stock Exchange-listed have fallen more than 57% over the past 12 months

*Bloomberg Baba’s stock chart

Baba stock also trades in Hong Kong, as shares jumped 11% today.

Alibaba said it repurchased about $9.2 billion worth of stocks,

as of March 18 under its previous program, that alone sums towards the new $25 billion total.

Citigroup analysts said the enlarged buyback plan was ;“likely the largest share repurchase program ever in China’s tech sector,”

- suggesting Alibaba’s management viewed its stock as severely undervalued, hence attractive to own.

But, many companies use buybacks to return cash to shareholders.

That usually is done to mainly support stock prices by signaling confidence in the company’s outlook and its financial health, while boosting earnings per share

S&P 500 firms outlined $238 billion of buyback plans in the first two months of 2022,

Some of the biggest U.S. technology companies,

have embraced even bigger repurchase programs than Alibaba. The likes of Google’s Alphabet Inc. and Microsoft Corp. earmarked up to $50 billion and $60 billion, respectively.