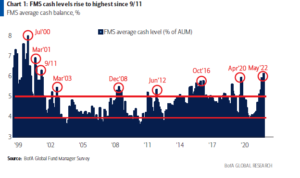

Bank of America, cash-oriented clients at highest level in decades!

Investors are piling into cash as the outlook for global growth plunges to an all-time low and stagflation worries mount, according to a Bank of America Corp. fund manager survey that points to continued stock market declines.

Cash levels among investors hit the highest level since September 2001, the report showed

with BofA describing the results as “extremely bearish.”

This month’s survey of investors with $872 billion under management also showed that hawkish central banks are seen as the biggest risk, followed by a global recession, while stagflation fears have risen to the highest since 2008.

*BoFA Chart illustration

The results make for a grim reading for global equities,

which have already suffered the longest weekly losing streak since the global financial crisis as central banks turn off the monetary taps at a time of stubbornly high inflation.

- Fears of a recession trumped the tail risks from inflation and the war in Ukraine, the survey showed.

The BofA survey also showed that technology stocks are in the biggest “short” since 2006. Frothy tech shares have been particularly punished in the latest selloff amid concerns about future earnings as rates rise.

Overall,

investors are very long on cash, commodities, healthcare and consumer staples, and very short on tech, equities, europe and emerging markets.