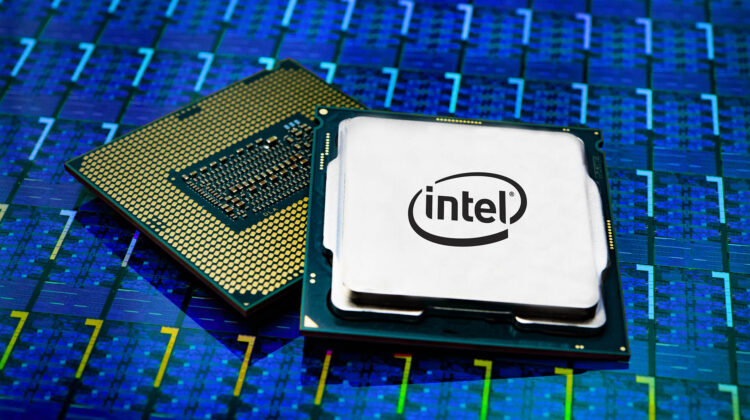

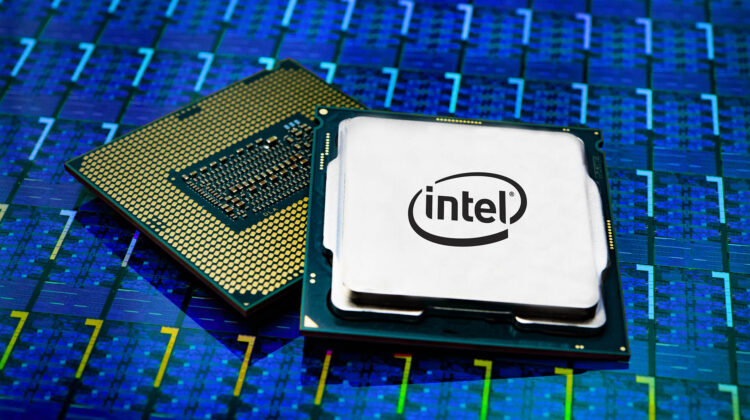

Intel signs $30 billion funding partnership!

Intel Corp. has struck an unusual $30 billion funding partnership with Brookfield Asset Management Inc.

The deal is to jointly finance its massive factory expansion ambitions, signaling some big investors are upbeat about the long-term demand for semiconductors.

Funding arrangement could be first of many such partnerships as U.S. chip giant expands manufacturing, Intel CFO says, WSJ finds

Tweet on Intel’s partnership deal

@intel has struck a $30 billion funding partnership with Brookfield Asset Management Inc. to help finance its massive factory expansion ambitions according to @WSJ

Many investors predict that market remains 'Bullish' on demand for semiconductors!https://t.co/5XgzaUNkwc

— The_Journalbiz (@the_journalbiz) August 24, 2022

The agreement with Canadian asset-management firm is the first of what could be a series of such arrangements

Intel is determined to its goals, argues Chief Executive Pat Gelsinger’s as the company is on the process of becoming the leading contract chip maker and regain its manufacturing advantage over competitors in Taiwan and South Korea.

Scott Peak, a managing partner in Brookfield’s infrastructure group, said such deals are common in industries including energy and telecommunications and are now trickling into the chip business because of its growing capital needs. Brookfield, which has more than $750 billion in assets under management, sees the Intel deal as a good fit with the company’s experience in large and complex deals, he said.

CEO Pat Gelsinger has pushed to make Intel a leading contract chip maker and regain its manufacturing advantage over rivals in Taiwan and South Korea.

Mr. Geslinger and other industry officials have said they expect annual semiconductor sales to roughly double by the end of the decade, topping $1 trillion even if short-term demand softness is weighing on chip-industry earnings.