Key factors for strategic investment

Opinion by Arben Selimi ( arben@thejournalbiz.com)

special contribution by the editor arsim@thejournalbiz.com

Investors expect returns on their investment, and protection from cash depreciation mainly through diversifying their portfolio as a safe hedge against inflation!

As it has always been the case, too much cash is a long term trouble, and diversification usually happens through stocks, bonds, real estate or any other asset, yet each potential investment is associated with a certain degree of uncertainty as the return is an element of the future and no one can predict the future.

Many investors rely on past performance of the stock, they identify a steady moderate (or exceptional) growth of the stock price and they base their investment decision, on this element alone, maybe also on the trending news articles of hot stock. This kind of investing is quite risky and does not guarantee positive returns, in fact it may lead to a total loss of investment. People who apply such an approach to investment are known as gamblers.

The professionals in the investment community usually use the value investing approach when deciding on their investments. Based on this approach, each investment instrument, be it common stock, bonds, real estate or any other, has an intrinsic value that can be determined by carefully analyzing the present condition and future prospects of the company represented by the investment instrument.

Whenever the market price of the instrument falls below the intrinsic value, the investor should buy immediately as opportunity arises, because this fall will eventually be corrected. and whenever the market price of the instrument rises above the intrinsic value, the investor should use the opportunity and sell the investment and thus reap good profits.

Investing is simply a matter of comparing company’s actual market price with its intrinsic value. That means that a professional investor will take into consideration the market price of the company and will compare it to its book value and see if is equal, grater or smaller than the other. When the two are equal this means that the company’s stock is neither overpriced nor underpriced which is a rare occurrence.

Most stocks are overpriced, i.e. the intrinsic value of the company is lower than its market price, and only in rare cases one might find a company that is underpriced. Once you have done your analysis and determined what’s the gap between the market price and intrinsic price then you are getting closer to an investment decision.

You need to gain an understanding of this investment approach in order to be able to make sensible investment decisions. It is also a prerequisite to keep you safe from losing your money.

However, with the current high inflation rate, you as an investor must take into account the inflation rate, as without it comparisons would not be accurate, The balance sheets from previous years show historic records/data that don’t match current metric – the dollar. One dollar from one year ago does not have the same value of todays’ dollar.

Tweet on the current global currency volatile markets

A Turbulent Day in Global Currency Markets!

-The dollar was on pace to set a new record high!

-The yen showed renewed weakness, despite last intervention

-The British pound tumbled to a record low below $1.035

-The Turkish lira also traded at its weakest level,18.45 against $ pic.twitter.com/NQjq3fP94b— The_Journalbiz (@the_journalbiz) September 26, 2022

*The currency market entered the most volatile period in 35 years

Let’s say you invested 1,000 $ in equity market one year ago, and the inflation rate is 10% year over year. If the price of your stock has not risen, then today those 1,000$ can only buy you 900$ worth of goods. The inflation wiped out 10% off of the value of your investment. So, to determine if your investment was worthwhile you must adjust for inflation, which means your investment should at least be worth 1,100$ just to retain the value of the original investment. Whatever goes beyond 1,100$ constitutes profit on your investment.

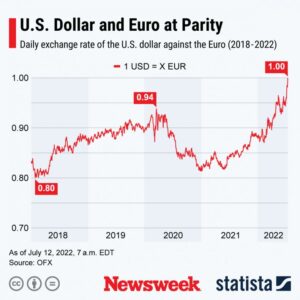

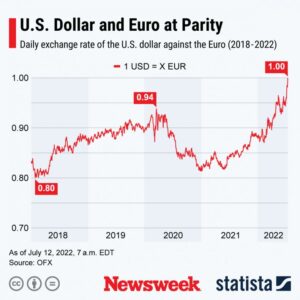

There is another element to this equation that can offset the effect of inflation – at least for those who use euro as their currency when investing – and that is the dollar against euro exchange rate. Dollar has gotten stronger in relation to euro over the past year and now is almost trading 1:1, whereas about a year ago it was trading at less than 0.80 This constitutes a 20% appreciation of dollar against the euro which means that whoever converted euros into dollars to buy stock a year ago and now wants to sell that stock will get a 20% profit due to the exchange rate alone. And if stock selling price is higher than its purchase price, the profit will be twofold at least

Statista chart on parity w/euro

Dollar reaching parity with euro, (*for the first time in 20 years) Chart by Newsweek/Statista

The strengthening of the dollar against the euro has had a positive effect on all investors who bought dollars with their euros, and not only with euros but also with other currencies – Japanese Yen, Chinese Yuan and British pound.

This strengthening of the dollar has served as a good hedge against global inflation for investors who have converted currencies like these into dollars.

Having these in mind, investors must exercise due diligence, consider all the factors that may affect the value of their investment and choose wisely where they will put their money.

@thejournalbiz

Opinion by Arben@thejournalbiz.com

Contribution and edition; arsim@thejournalbiz.com