Microsoft, to cut earnings guidance for this quarter!

Microsoft, cut sales and earnings guidance for the current quarter, citing the impact of foreign exchange rates as the stronger U.S. dollar takes a toll!

Economic weakness in other parts of the world has helped propel the U.S. dollar to record highs against its trading partners, which comes as U.S. inflation is at or near its highest level in nearly 40 years.

The U.S. Dollar Index, is up more than 6% so far this year and hit its highest level since 2002 last month. Dollar’s climb has sent the euro, UK’s pound and Japanese yen tumbling

Tech giant’s stock slips; as stronger dollar’s impact on financials

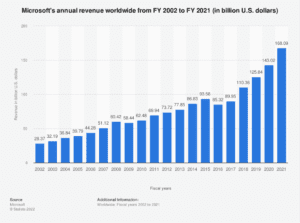

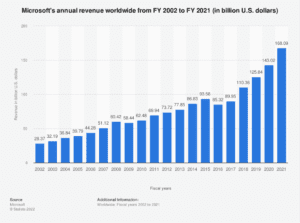

*Microsoft Chart growth 2016-2021

The software giant said in a securities filing, it now expects fiscal fourth-quarter sales of between $51.94 billion and $52.74 billion, down from its prior guidance of $52.4 billion to $53.2 billion. The quarter ends June 30.

Earnings are expected to be between $2.24 a share and $2.32 a share, down from prior guidance of $2.28 a share to $2.35 a share.

A strong dollar allows Americans to buy goods from other countries at lower prices. But it can also hurt U.S. manufacturers by making products more expensive for foreigners, and it means U.S. businesses receive fewer dollars for their exports.

Microsoft said in its April earnings report that a stronger dollar reduced the software company’s revenue and earnings by $302 million

Microsoft is the latest multinational company to warn of the stronger dollar’s impact on financials. Salesforce Inc. earlier this week cited the stronger dollar in lowering its sales outlook for the year.

*Microsoft shares fell 2.6% in early trading to $265.31…they are down around 21% year to date.