Warren Buffett invested $1billion in a crypto-friendly Nubank

Berkshire Hathaway made its crypto investment public with a SEC filing earlier this week.

It revealed that Buffett’s company had purchased $1 billion in shares of Nubank, a digital bank based in Brazil, and the largest of its kind in Latin America.

Berkshire’s chairman and CEO has not refrained in the past from calling cryptocurrency “rat poison” and an unproductive asset with no instrinsic value

Those were once the words of Warren Buffett, the famous investor called the “sage of Omaha” but now his money is saying otherwise.

Specifically, his company Berkshire Hathaway has bought $1 billion worth of stock in a digital bank that focuses on crypto, Fortune reports

Nubank a type of bank that operates outside of the rules of the traditional banking system. The digital bank’s investment unit, NuInvest, allows users to put money in a Bitcoin exchange-traded fund (ETF)—tapping a financial space that Berkshire’s leaders have shown little love for

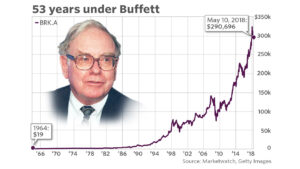

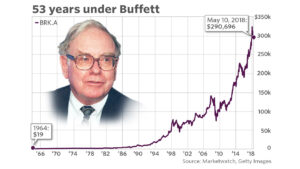

*Marketwatch chart of Buffet’s role at Heathway Inc

Charlie Munger, Buffett’s longtime partner and vice chairman of Berkshire Hathaway, recently stated that he wished cryptocurrency had “never been invented”

Munger has a particular distaste for Bitcoin, the most popularly traded cryptocurrency, once calling it “disgusting and contrary to the interests of civilization.” Munger has supported China’s decision to ban Bitcoin trading in the country and has called on the U.S. to take similar measures.

- “The Chinese made the correct decision, which is just to simply ban them,” he said.

But even though its owners have expressed their personal disdain for cryptocurrencies and the crypto market

Berkshire Hathaway’s latest investment in Nubank is not the first time the conglomerate has dabbled in this market.

Berkshire already bought a $500 million stake in Nubank last summer, months before the company went public in December 2021.