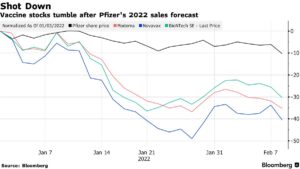

Pfizer Biontech Decline in market as ‘omicron’ retreats

Shares of vaccine makers slumped again, losing over $20 billion in market value

Immediately after Pfizer Inc. issued revenue guidance of its C-19 jab and pill that fell short of analyst expectations.

BioNTech and Moderna Inc. dropped 5.6% and 3.5%, respectively, while Pfizer slid over 4% to a more than two-month low after its 2022 sales and profit outlook both missed analyst expectations.

Wall Street retains the outlook on Pfizer, reaffirming that its virus franchise throughout the year will be on demand, as government contracts are solidified, but it may not be enough to return the sector to its former glory.

Pfizer’s “concentration risk is high, given elevated market expectations,” wrote market analyst with Citi. He views the stock as “more fragile than others in the sector, given the C-19 dynamics.”

In addition Novavax Inc. which trailed other companies in getting its vaccine to market, sank the most, dropping as much as 14% after Reuters reported that it’s coming up short on shipments in Europe and other regions.

Novavax filed for an authorization of its vaccine in the U.S. at the end of 2021.

*Bloomberg chart

Market interest in makers of Covid jabs has cooled over the past few months and valuations have drifted lower as the market awaits a declaration that the virus has moved from a pandemic to a disease we coexist with, like the flu.

- Moderna, BioNTech and Novavax have all fallen more than 35% combined since the start of 2022, while Pfizer alone is down roughly 14%.

“We expect the future projections to continue fluctuations, keeping the long-term sustainability of these sales,” analyst JPMorgan analyst.