Sustainability green renewable energy (ESG)

The journlabiz.com will cover the new environmental business related field, especially, the big tech who are a key influencers in a global market and leading the drive towards the transition into a green, electric powered industry, starting from Tesla and slowly reaching all the auto-industry, semi-trucks, and whole global fleet that is estimate to be worth of trillions of dollars transition

Now the key point on renewable energy;

ESG, sustainability

– In response to the escalating climate crisis, new environmental legislation, a global pandemic and the resulting financial crisis, business and financial leaders have been forced to rethink the fundamentals of mainstream business models.

– News focus more on environmental concerns and organizational resilience, a transformation is underway, that inextricably links sustainability with competitive advantage.

– Most organizations are familiar with sustainability–but sustainability does not operate independently. A correlation of wind, solar and electric transformation will be a mosaic of the weekly news at the journlabiz

– Renewable energy projects, correlation with social values and outcomes, all of which are driven and supported by corporate governance.

Defining the Environmental, Social and Governance aspects of ESG

E = Environmental Criteria

· The E considers how each organization affects and is affected by its environment. Sustainability planning is essential to successfully address the E in ESG.

S = Social Criteria

· The S considers how a company manages its relationships with employees, suppliers, customers, and communities.

G = Governance

· The G considers the internal systems, stakeholders, controls and procedures that an organization has in place to govern itself, make effective decisions, and comply with regulations.

Importance of ESG

– Sustainability planning is a major player in ESG. However, integrating renewable energy into a global energy strategy and tracking the subsequent carbon reductions is only the beginning. The events of 20/21 have shined a light on the social and governance practices of organizations, giving ESG and sustainability even greater relevance–not only for investors, but consumers, suppliers, and the government as well.

How Does ESG and sustainability Create Business Value?

– The ESG values and practices of a business can not only impact an organization’s resiliency, sustainability, and surrounding community, but the global economy and environment as well.

– Multiple studies indicate that companies considered to be good corporate citizens perform better financially than those that don’t. Here are five ways in which ESG can create business value for organizations in all markets and industries.

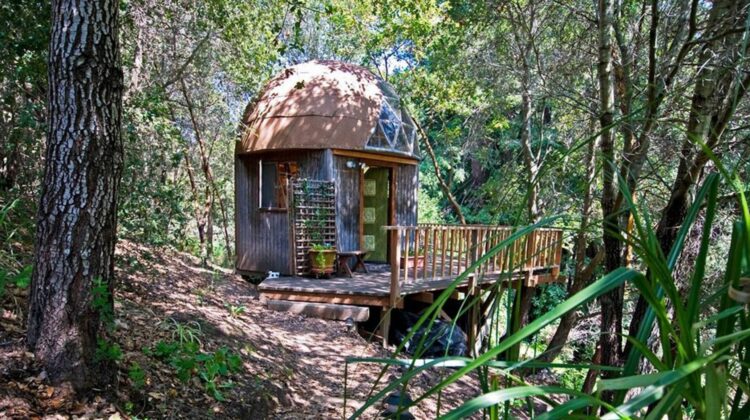

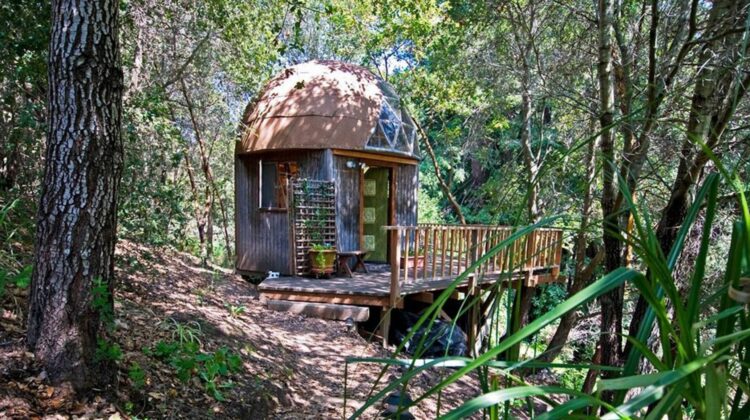

1. Merging Environment and Business goals

Whether it’s a wind or solar energy project or buying renewable energy credits (RECs), renewables help to reduce costs and energy price volatility while offsetting carbon emissions and boosting public appeal.

2. Energy Independence

The increase in extreme weather events is increasing energy price risk. Gaining independence from commercial energy supply sources by generating your own electricity through renewable energy, or subscribing to a community solar program, reduces or removes your dependency on the local power utility and helps to stabilize price risk.

3. Cost Reductions and Financial Incentives

Local, state and federal governments support the move toward renewable, clean energy and lowering greenhouse gases. Therefore, several financial incentives and assistance programs are available to organizations participating in clean energy initiatives. These programs can vary greatly by region, so it pays to have a sustainability plan in place and to understand the clean energy opportunities in your area.

4. ESG and potential Return on Investment

The events of 2020 proved to be a major turning point for ESG investing with environmental, social and governance criteria ranking alongside traditional financial metrics according to Bloomberg. The trend is foreseen to accelerate in 2012 and onwards